Are you covered if looting, vandalism and violence hit close to home?

In April, Baltimore roiled with some of the worst rioting in decades. Cars were burned, buildings vandalized and shops looted. Two days of rioting resulted in millions of dollars of damage to city-owned property, businesses and personal property. It was a similar situation last summer and fall in Ferguson, Mo., where rioters capitalized on organized protests and violent unrest came in two waves.

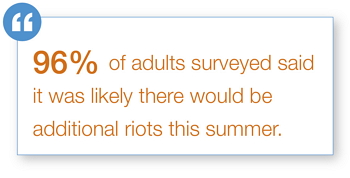

According to a recent NBC News/Wall Street Journal poll, 96% of adults surveyed said it was likely there would be additional riots this summer, and many think they will hit close to home.  About half of the people surveyed said they expect riots in the metropolitan area nearest them.

About half of the people surveyed said they expect riots in the metropolitan area nearest them.

Riots can be frightening and upsetting and, for those in the thick of it, they can be dangerous - and quite costly. Will your insurance cover you if riots break out near you? Here are answers to questions about riots and your personal insurance.

Do you need riot coverage?

Just about any even can trigger riots. In 2011, after the Vancouver Canucks lost the Stanley Cup Finals to the Boston Bruins, fans took to the streets, vandalizing businesses, smashing windows and setting cars on fire. Even in victory, fans can get out of control. Another victory celebration turned ugly riots in San Francisco last year after the Giants won the World Series.

While the worst U.S. riots have occurred in metropolitan areas (Los Angeles, Detroit and Miami), it's not only city dwellers who are affected by civil disorder. Ferguson, for example, is a suburban community that had a very low violent crime rate prior to last year's riots.

No matter where you live, it makes sense to learn what is covered (and what's not) if civil unrest occurs in your neighborhood.

What happens if your home is vandalized or damaged?

Fortunately, most

homeowner’s policies cover damage caused by a riot, civil commotion, vandalism, fire or “malicious mischief,” according to the Insurance Information Institute (III). This includes damage to the structure of the home as well as any personal possessions.

If your home is uninhabitable because it was damaged by an insured disaster, a standard policy will provide coverage for something called additional living expenses. This helps cover your costs (hotel bills, restaurant bills, etc.) while living away from home. The same applies to

renter’s insurance.

What happens if your car is vandalized or damaged?

Only if your

auto insurance includes an additional, optional comprehensive policy, will your car be covered if damaged (windows smashed, tires slashed, set on fire, etc.) during a riot. A comprehensive policy reimburses car owners for loss due to theft, or damage caused by something other than a collision with another car or object, such as fire, flood, vandalism and riot. According to the III, about 75% of U.S. drivers opt to buy this optional coverage. Of course, if you are found guilty of any illegal activity related to the riot, your insurance company could deny all claims.

Most people don’t wish for violent unrest; but if it comes, make sure you’re covered for it.

Contact a HUB expert today to learn more about your coverage options.