Examining and renegotiating pharmacy benefit management

contracts can help trim drug spending.

Earlier this fall, drug maker Turing Pharmaceutical made headlines for abruptly raising the price of one of its drugs 4000%, from $13.50 to $750 per tablet. News of the astronomical increase sparked a media and social media firestorm. Provider groups, pundits and consumer

advocates took Turing (and, by association, the pharmaceutical industry) to task, with some citing the proposed increase as evidence of the need for consumer protections against excessive pricing.

For employers, however, soaring drug costs is old news. In recent years, employers have seen per-member pharmacy costs rise and pharmacy spending account for a greater share of total health spending. According to the fifth annual “Prescription Drug Benefit Survey” by Buck Consultants at

Xerox, 77% of employers spend 16% or more of their total healthcare budget on pharmacy benefits and nearly 5% of employers spend upwards of 30% of total healthcare spending on pharmacy[1].

Its no wonder employers are looking for innovative ways to manage their pharmacy spend. Many, however, overlook the simplest and least disruptive path to savings: their pharmacy-benefit-management (PBM) contract.

“Interestingly, it’s the least analyzed component of healthcare benefits. Most people have no idea what’s under the hood, as these contracts are usually in place for years without anyone taking a look at them,” said

Lerone Sidberry, president of Central Region

Employee Benefits at HUB International. “There is a significant opportunity to improve the contractual terms that drive employers’ pharmacy costs. In fact, we know from years of experience that when experts negotiate with the current pharmacy benefits

manager, the terms can easily be improved upon.”

The

Rx landscape

The

Rx landscape

Last year,

prescription drug spending reached a record-breaking $374 billion[2]. That’s up 13% from 2013 - the largest percentage increase in over a decade. Breakthrough therapies and specialty drugs were the main driver of the increase[3].

“New biotech medicines are difference-makers in the market. The hepatitis C drug has a 95% cure rate if taken correctly; but it also carries a very high price tag,” said Bryan Statham, president of RxBenefits, a pharmacy benefits-management administration and consulting

firm. “As a result of these expensive prescriptions, the specialty pharmaceutical drug-spend is the fastest growing component of medical spend for employers.”

While specialty medications represent only about 1% of all U.S. prescriptions, in 2014 they accounted for more than 30% of the total drug spend[3]. And spending is only expected to climb higher: CVS/Caremark, a pharmacy benefit management company, predicts that specialty-drug spending will more than

quadruple by 2020, reaching approximately $402 billion a year[4]. By then, specialty drugs will account for 40% of employers’ total pharmacy spend, according to the Midwest Business Group on Health.[4]

Help

wanted

There has never been a better time for employers to look at their general and specialty pharmacy strategy to see if they have optimal pricing terms and other strategic savings opportunities. To help employers ensure they have the best PBM contract terms, HUB International

provides free contract reviews to clients in partnership with RxBenefits.

“As a result of the review and renegotiation HUB and RxBenefis provides, employers are seeing a savings of anywhere from 6% to 35%, with average annual savings of 18%,” said John W. Parker , vice president business development. “That’s savings attached to moving one

pricing contract to a more aggressive pricing contract. There is a potentially significant financial value to having your contract reviewed and renegotiated.”

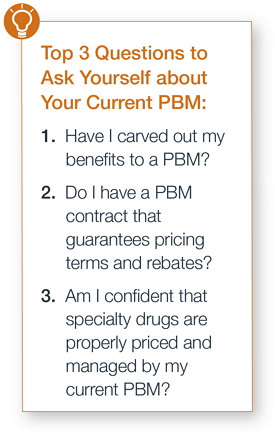

Together, HUB’s benefits team and RxBenefits recommend that employers ask themselves the following questions about their current pharmacy benefits to determine the potential for savings:

1) Do I know the terms of my contract and if they are optimal in today’s market? (If your medical carrier is managing your pharmacy benefits, you may not know the specific contract terms. And if you haven’t negotiated the terms significant savings are possible.)

2) Do I have a PBM contract that guarantees pricing terms and rebates? Is it auditable, with a recovery process for any shortfall in performance?

3) Am I confident that specialty drugs, like those for hepatitis C, are being properly priced and managed by my current provider?

If you answered ‘no’ to any of these questions, it makes sense to perform a review or audit of your pharmacy spend. “If you haven’t performed—at a minimum—a review of your PBM contract in the last 12 to 18 months to determine if it’s performing properly, you’re missing out on a

tremendous opportunity to manage drug spending,” Sidberry said.

Contact your HUB employee benefits team to find out how your business can review and re-negotiate your pharmacy benefits contract.

[1] 5th Annual Buck Consultants at XEROX Prescription Drug Benefit Survey

[2] Prescription Drug Trend Report

[3] Express Scripts Drug Trend Report

[4] New CVS Caremark Report Projects Annual Specialty Drug Spending Will Quadruple 402 Billion