Minimize your risk of litigation in wage and hour disputes by enforcing meal and rest breaks.

Employees working at an amusement park are required to park at the end of the large parking lot, only to clock in 20 minutes later when they reach their post. Should the time they travel from the parking lot to their post count as work time?

If the only nurse in an urgent care facility has to forfeit her lunch break because a patient walks in, can she bring a wage and hour claim against her employer?

These real-life examples provide insight into the wage and hour debate that has intensified in recent years as employment practice liability claims continue to rise.

“Often times, employers are baffled by the labyrinth of federal, state and even local employment law requirements. With wage and hour laws, there have been so many recent developments, it is difficult to determine: What applies to my business? How can I comply with current and future wage and hour laws while maintaining a

profitable business?” said Karen Silverman, RPLU, CPCU, CEBS, ARM, Policyholder Counsel, HUB International. “A lot of employers err on the side of caution, taking a more conservative approach to ensure that they are less susceptible to a wage and hour claim.”

What does the law say?

Employers must comply with the most important federal wage and hour law, the Fair Labor Standards Act of 1938 (“FLSA”), as well as their state laws, including wage orders and governing case law.

Federal law requires that employees be relieved of their duties during meal periods. The governing test on whether a meal period is compensable under wage and hour laws is known as the “predominant benefit” test. The question is: Who is receiving the predominant

benefit? If the employer is predominantly receiving a benefit, that time is compensable. If the employee is able to use this meal period time as they wish, it is typically not compensable time.

Many employment lawyers recommend that employers follow the local state law standard, or even better, match a more conservative state’s employment law statute. For example, California has one of the more conservative standards when it comes to an employer’s obligation to provide a rest

period, and therefore many employers operating in states with less stringent laws will often adopt California’s standards.

What

does this mean for employers?

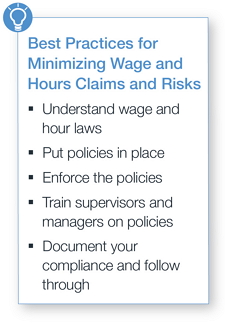

In order to safeguard against wage and hour claims, employers can follow these steps to minimize their risk of litigation:

1. Understand

your market/industry’s wage and hour specifics. Stay current on wage and hour laws, rules and regulations, but also be mindful of wage orders that apply to your industry, as some industries will have a different standard, including healthcare and home care, personal services, apparel, agricultural,

sales and drivers. Employers should understand their industry standard and what constraints they face that may cause them to be non-compliant. For example, restaurants and retail stores will have an ebb and flow of patrons that may make taking breaks at specific intervals difficult. These employers, for example, should

have additional staff on during a dinner rush or the holiday season to ensure compliance.

1. Understand

your market/industry’s wage and hour specifics. Stay current on wage and hour laws, rules and regulations, but also be mindful of wage orders that apply to your industry, as some industries will have a different standard, including healthcare and home care, personal services, apparel, agricultural,

sales and drivers. Employers should understand their industry standard and what constraints they face that may cause them to be non-compliant. For example, restaurants and retail stores will have an ebb and flow of patrons that may make taking breaks at specific intervals difficult. These employers, for example, should

have additional staff on during a dinner rush or the holiday season to ensure compliance.

2.Make

sure employees are aware of the policies and procedures. Get written acknowledgement from each employee that they understand the governing wage and hour policies and procedures.

3. Enforce

the policies and procedures. Sounds obvious, but it isn’t. If you require a sales person to take a break for 30 minutes in the middle of the day, but don’t have anyone to relieve them, the policy can’t be enforced. Make sure additional staff is on-site, or at least someone in a

managerial role, who will fill in for each worker to ensure they take their breaks.

4. Train

supervisors and managers accordingly. Supervisors and managers should receive instruction on both applicable wage and hour laws and how to encourage employees to stick to the break schedule.

5. Document

it. Employers should track both meal and rest breaks on a timesheet or online timekeeping program, as these records can become useful should the case go to court. Include a confirmation from the employee that the hours are a true and accurate account. Further, managers should also be required to confirm these hours are

correct.

Where does insurance fit in?

Employment Practices Liability (EPL) coverage protects businesses from the financial costs incurred from employment-related lawsuits. For employers with a lot of employees and third-party interaction, EPL insurance is recommended and can sometimes be purchased with

an additional wage and hour defense sublimit.

In order to get the additional wage and hour defense coverage though, insurance carriers will want to know what controls and procedures are in place to prevent a claim from surfacing. Are breaks enforced for blue collar (non-exempt)? Has the business

had a previous EPL or wage and hour claim? Has the employee handbook been reviewed by an attorney?

Unfortunately, an additional wage and hour sublimit is difficult to secure, due to both lack of carriers, high carrier standards and exorbitant carrier pricing. Therefore, many companies will mitigate the potential issues as much as possible from an internal

risk management standpoint.

“The best possible thing you can do, with or without a wage and hour sublimit is to prepare as an insurance carrier would. Ask all of the questions an insurance carrier would ask, and speak to a skilled employment lawyer,” said Silverman. “Make sure you have policies,

maintain records beyond the statute of limitations and, if possible, have a law firm on call, who is familiar with your company. You cannot prevent these claims; you just have to be prepared for when they happen.”