Leverage voluntary benefits as a means to fund benefits education.

There’s much talk these days

about the negative intended and unintended consequences of health care

reform. But, like everything in life, there’s a silver lining here, too.

More employers than ever are

now using voluntary benefits to fill coverage gaps for their employees as they

move to high-deductible plans. But, what employers might not know about

offering voluntary benefits is that they can also be an efficient and

cost-effective way to communicate your total benefits package to employees.

Voluntary benefits plans are

naturally structured to include funding for a benefits communication and education

program that can often include a specialized enrollment education firm with enrollment

technology - available at no additional cost to the employer.

“Introduced through the commissions built into

the voluntary or personalized benefits, an enrollment and education firm takes

a resource-intensive element of the job off the company’s HR staff and actually

creates a new line of communication with employees about their benefit options,”

said

Joe Torella, East Region President, Employee Benefits Division, HUB

International. “If we’re giving people more choice

around their benefits, we need to communicate their options to them in a way we

haven’t previously done. This more employee-centric approach is the impetus for

the shift from voluntary to personalized benefits.”

“Introduced through the commissions built into

the voluntary or personalized benefits, an enrollment and education firm takes

a resource-intensive element of the job off the company’s HR staff and actually

creates a new line of communication with employees about their benefit options,”

said

Joe Torella, East Region President, Employee Benefits Division, HUB

International. “If we’re giving people more choice

around their benefits, we need to communicate their options to them in a way we

haven’t previously done. This more employee-centric approach is the impetus for

the shift from voluntary to personalized benefits.”

Voluntary coverage can

include accident, critical illness, hospital indemnity and dependent health

coverage, legal, life, disability, travel and even pet insurance. The new line

of communications around voluntary benefits can be championed by both in-house

and third-party benefits specialists working in tandem and can include any

combination of print and online materials, one-on-one meetings and benefits seminars

for employees.

A Win-Win

We already established that

voluntary benefits help the employer, as product choices made by the employees

help fund initiatives that the employer has around enrollment, education or

communications. But, the employee also wins. For many employees, purchasing voluntary

benefits can be a new and rewarding experience. When the employer directs

investments to employee communications and education, employee engagement and

satisfaction increase.

“Some of the employees we

work with haven’t sat down with an HR representative on a one-on-one basis

since they were hired,” said Torella. “But, the fact is that employees are more

content when they choose their own voluntary or personalized benefits. When

they get the message: ‘My employer wants me to buy coverage that’s valuable to

me not just a catch-all plan they’ve chosen,’ they tend to choose a more

efficient array of benefits that better meet their needs and the needs of their

families.”

Additionally, most voluntary

benefits will be excluded from the Cadillac Tax, a non-deductible excise tax on

“Cadillac-style” healthcare benefits. For

all these reasons, more and more employers are leveraging voluntary benefits together

with a combination of traditional group medical and ancillary lines of coverage

as a means of filling the coverage gap left by new high-deductible plans.

Multi-Year Strategy

Key to introducing voluntary

benefits to employees is creating a three- to five-year strategy around all

your benefits plans (see Viewing Employee Benefits from 50,000 Feet).

Key to introducing voluntary

benefits to employees is creating a three- to five-year strategy around all

your benefits plans (see Viewing Employee Benefits from 50,000 Feet).

“A good broker will build a

multi-year strategy around your organization’s KPIs and create a personalized benefits

palette for your employees that makes the most sense for them based on the life

stage and activities they are engaged in,” said Torella.

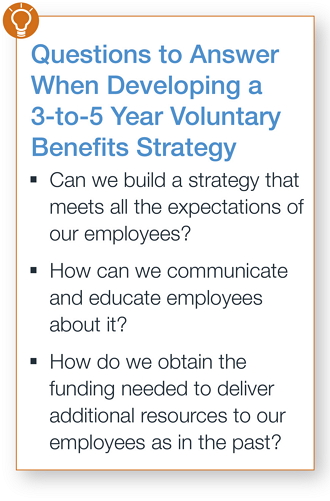

Torella further suggests

that employers should ask themselves the following questions when developing a three-

to five-year strategy that includes voluntary benefits:

- Can we build a strategy that meets all the expectations of our

employees?

- How can we communicate and educate employees about it?

- How do we obtain the funding needed to deliver additional resources

to our employees as in the past?

Overall, given the many

objectives of a multi-year strategy, improving employee satisfaction around all

benefits –voluntary, medical and ancillary coverage is critical. Torella

recommends starting with an employee survey. Find out what types of coverage are

important to your employee base and start there when it comes to determining

the best voluntary benefits to offer.

Contact your HUB Employee

Benefits specialist today to find out how your business can take advantage of voluntary

benefits and the enrollment education that comes along with them.