Know which agencies and compliance directives put your business at risk.

In 2012, the

first wave of audits enforcing health care reform compliance directives under

the Patient Protection and Affordable

Care Act (ACA) ran its course. Just three years later, the risks have

further elevated as other government bodies that co-enforce the ACA are

introducing new audit activities of their own.

“The reality is that government entities

are now working in tandem under inter-agency ‘memorandums of understanding’ that

communicate with each other about their audit findings,” said Dennis Fiszer,

Chief Compliance Officer, Eastern Region, HUB International. “If an auditor

notices a problem outside of his or her enforcement zone, the auditor will often

pass along specific ‘tips’ about which organizations have compliance weaknesses.”

The reason for this new surge in audits

is three-fold:

- ACA Funding Gap –

As the gap grows larger, the government will become increasingly compelled to

make up the shortfall by seeking penalty enforcement recoveries.

- ACA Complexity - ACA-related

regulations are estimated to be over 25,000 pages. The scope of these

requirements and the lack of detail on how it applies to real world situations

all heighten the risk for compliance breakdown and therefore potential audits.

- Employee or Plan

Participant Complaints - Every agency now maintains an online presence soliciting

the public to communicate with them directly about workplace issues they

witness, which can trigger audits.

Employers must ramp up their

efforts to ensure compliance ahead of a potential audit. The best way to do

this is to know which government entities and laws could put your business at

risk.

Common Employee Benefits Audit Triggers

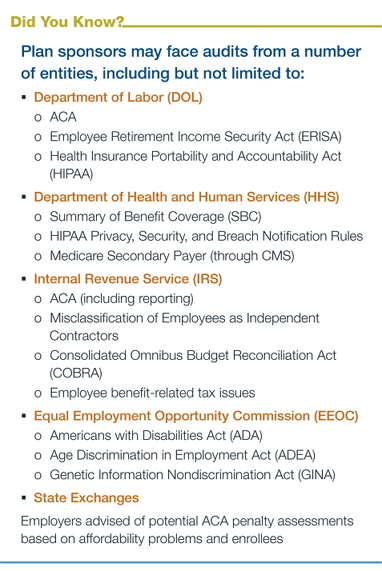

In addition to some state

exchanges, federal agencies including the Department of Labor (DOL), the Department

of Health and Human Services (HHS), the Internal Revenue Service (IRS) and the Equal Employment

Opportunity Commission (EEOC), have all increased audit activities, targeting

specific directives (see side bar for a complete list). The

following are a few common audit triggers that apply across markets.

DOL Audit Triggers

- Age 26

coverage: Health

plans must provide a sample of the written notice describing enrollment rights

for dependent children up to age 26 who have used the plan since September

23, 2010.

- Retroactive

coverage takeaways (recessions): If the plan

has rescinded coverage, it must supply a list of all affected individuals

and a copy of the written notice 30 days in advance of each

rescission. For any identified rescissions, the auditor will seek to

discern whether the ACA’s fraud standard, or an intentional

misrepresentation of a material fact, justified the rescission.

- Grandfather

status:

Employers that are retaining grandfathered plan status must provide

documentation to substantiate that status, as well as a copy of the

required annual notice distributed to participants advising of the plan’s

grandfather protections. Not surprisingly, the agencies are generally

unfriendly to grandfather protections and may scrutinize the validity

behind an employer’s attempt to assert such status.

- Waiting

periods: Plan

sponsors are precluded from using waiting periods that delay coverage beyond

90 days from hire date. The DOJ may examine whether that occurred in a

representative number of situations, but most especially if an employee

has complained of a potential violation.

IRS Audit Triggers

- ACA

reporting: The

ACA now requires a self-reporting employer mechanism to assist the IRS

with oversight of the federal mandate to offer full-time employees

“minimum value” health coverage at an “affordable” contribution. In the

future, failures associated with employer reporting (primarily the 1094-C

and 1095-C forms) can trigger penalties of $100 per incident up to $1.5

million. Employer reporting could

also reveal additional underlying employer health coverage mandate

violations. Although those penalties are triggered separately, mistakes

have the potential to produce substantial fines. And assessments exceeding

$3,000 annually may be triggered for specific people if the coverage is

not actually affordable, even if the employer has comprehensively offered

coverage to its entire full time workforce.

- Hours

tracking: Under the ACA, the standard for

eligibility has been set at 130 hours per month. An employer with a

workforce that keeps unpredictable hours - including those expected to

work fewer than 130 hours per month - will necessitate the use of

complicated “variable hour” tracking and status designations, which can

invite significant enforcement scrutiny.

Ramp Up Compliance Efforts Today

Just as audit failures can result in

significant penalties for organizations that sponsor employee benefit programs,

similarly enforcement agencies benefit greatly from this supplemental revenue,

even using it to hire more auditors (as has been seen with CMS Medicare

Secondary Payer enforcement).

“Although federal regulators have

publicly indicated that for the initial phases of ACA compliance, the agencies ‘wish

to cooperate’ with employers to help them understand the new law before

throwing the book at anyone, HUB recommends that employers ramp up compliance

efforts now to help ensure they do not bump into problems down the road,” said

Fiszer.

For any employer that is contacted by an

enforcement body, HUB suggests a comprehensive and organized response to help

push the government towards an easier target. The more prepared and organized a

plan sponsor is in advance, the more efficiently and swiftly a plan-related

compliance audit can be resolved. For more information on how to avoid these

and other penalties triggered by an audit, contact your HUB Employee Benefits

team.